cryptocurrency tax calculator uk

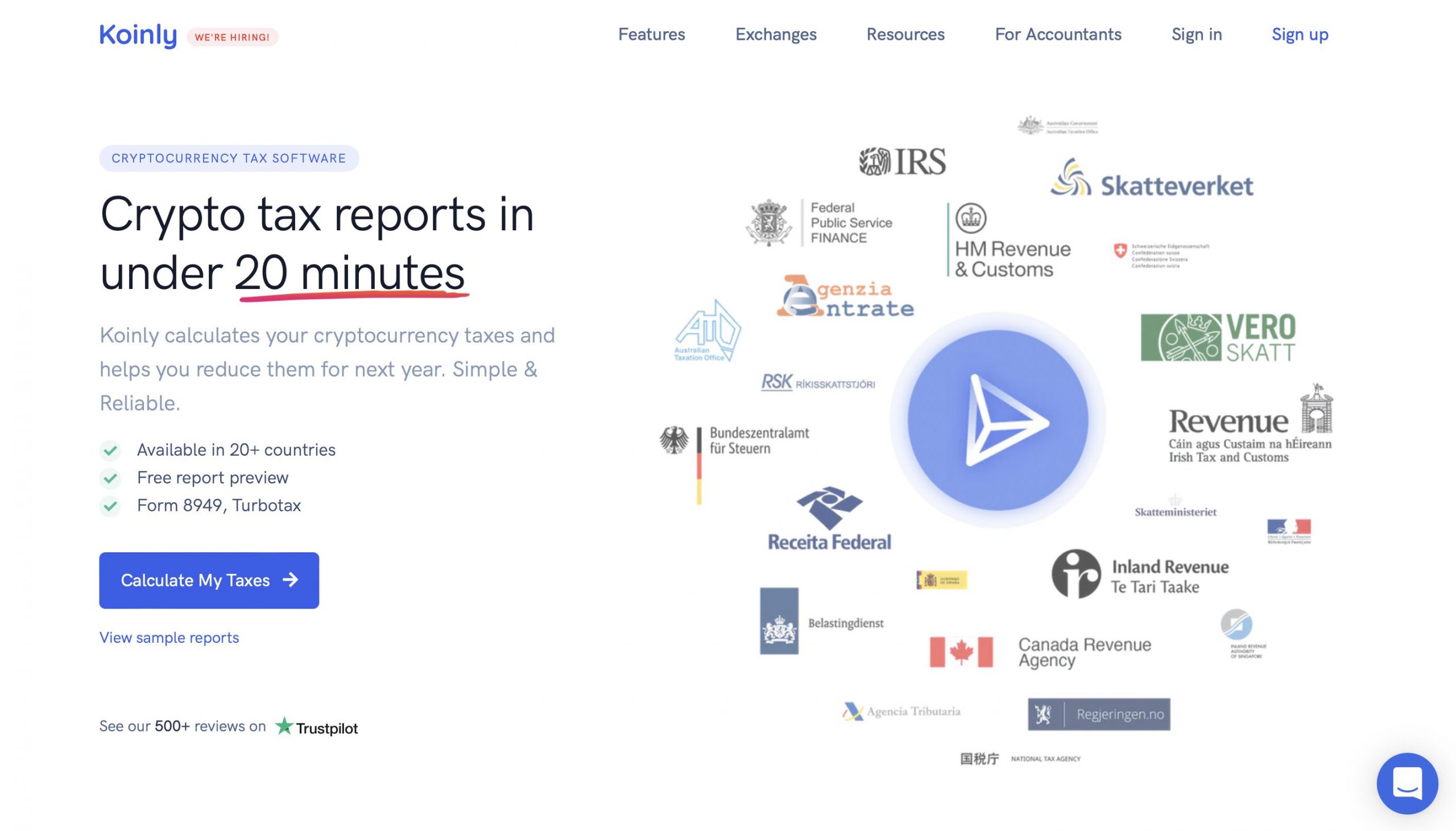

File your crypto taxes in UK Koinly helps UK citizens calculate their crypto capital gains. Whether you are a taxpayer looking to get an accurate crypto tax report a business looking to track your inventory or an accountant.

10 to 37 in 2022 depending on your federal.

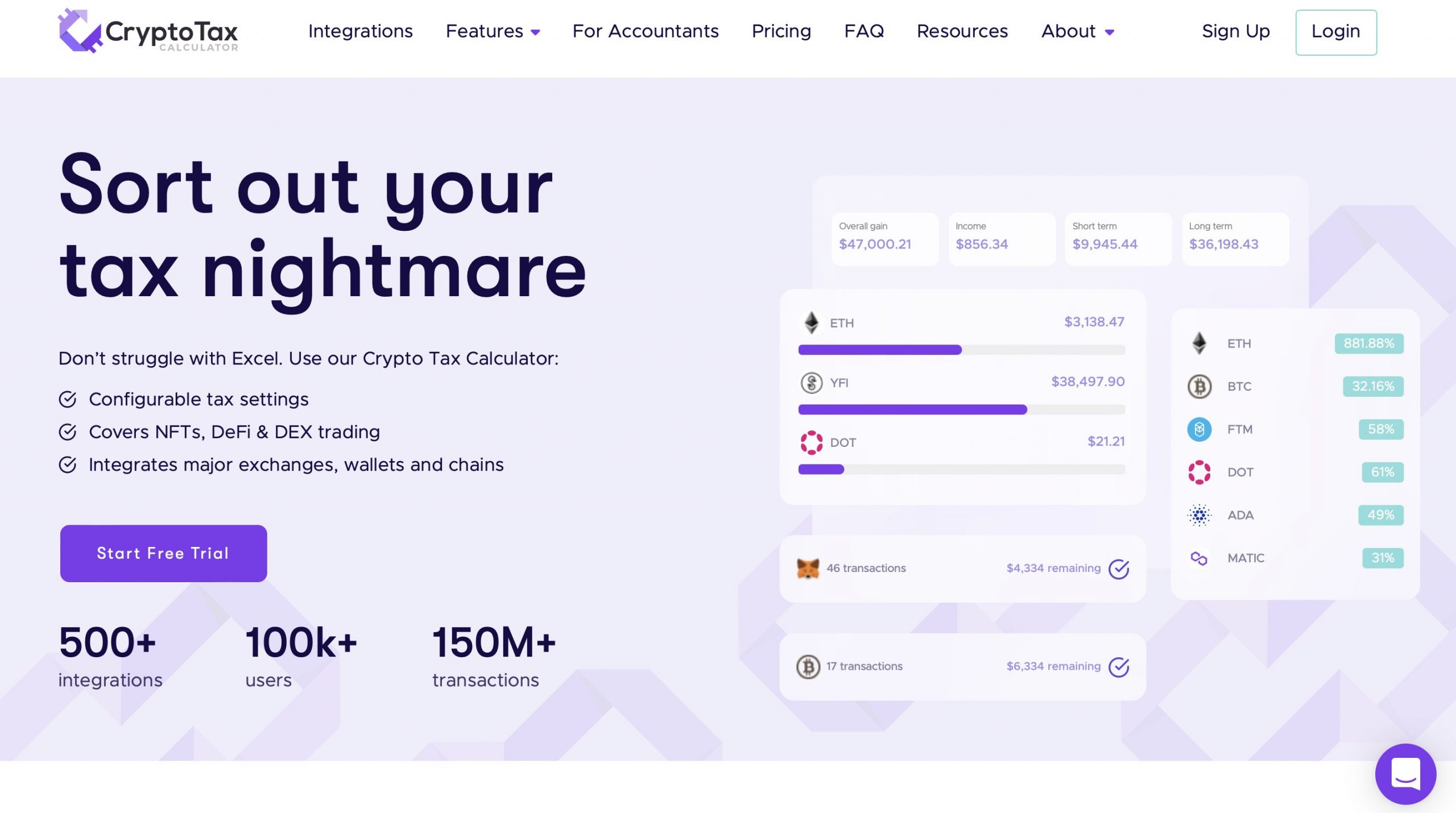

. Short-term crypto gains on purchases held for less than a year are subject to the same tax rates you pay on all other income. Start for free pay only when you are ready to generate your reports its website states. CryptoTaxCalculator is designed to support the unique HMRC reporting requirements including UK-specific Same Day and Bed Breakfast wash sale rules.

It takes less than a minute to sign up. HMRC has published guidance for people who hold cryptoassets or cryptocurrency as they are also known explaining what taxes they may need to pay and what. This site aims to provide a simple overview of UK tax rules for newcomers to bitcoin and cryptocurrency.

Calculate your crypto taxes and learn how you can minimize crypto taxes for the USA UK Canada and Australia. The Result is. Simply copy the numbers into your annual tax return.

How is crypto tax calculated. Enter your income for the year. For example if you buy 1 BTC at 1000 and a second BTC for 3000 your average cost would.

You can be liable for both capital gains and income tax depending on the type of cryptocurrency transaction and your individual circumstances. This tool is designed to be used by someone who is already. Use our Capital Gains Tax calculator to work out what tax you owe on your investment profits.

Crypto tax calculator software lets the users connect or import their cryptocurrency transaction data mainly the purchase price sale price and the crypto tax calculator tool automatically. To generate tax reports for filing. The HMRC uses an average cost basis to calculate the cost on capital gains.

The platform is also to start using Koinlys crypto tax calculator. BittyTax is a collection of command-line tools to help you calculate your cryptoasset taxes in the UK. You can also generate an Income report that shows your income from Mining Staking Airdrops.

Create your free account now. Capital Gains Tax is basically a tax that youre charged on money you make from selling an. Generate complete tax reports for mining staking airdrops forks and other forms of income.

Choose how long you have owned this crypto. To calculate your capital gains as. Although all information provided has been verified in communication.

Choose your tax status. Calculating cryptocurrency in the UK is fairly difficult due to the unique rules around accounting for capital gains set out by the HMRC. The cryptocurrency tax calculator youll enjoy using.

You pay 127 at 10 tax rate for the next 1270 of your capital gains. Filing your taxes is already complicated but it can be more. You pay 1286 at 20 tax rate on the remaining 6430 of your capital gains.

Best Crypto Tax Software Top Solutions For 2022

11 Best Crypto Tax Calculators To Check Out

11 Best Crypto Tax Calculators To Check Out

How To Calculate Cost Basis In Crypto Bitcoin Koinly

11 Best Crypto Tax Calculators To Check Out

Cryptocurrency Tax Calculator Forbes Advisor

How To Calculate Crypto Taxes Koinly

Track Your Cryptocurrency Portfolio Taxes Cointracker Is The Most Trusted And Secure Cryptocurrency Portfolio Tr Tax Guide Cryptocurrency Buy Cryptocurrency

11 Best Crypto Tax Calculators To Check Out

![]()

Cryptocurrency Bitcoin Tax Guide 2022 Edition Cointracker

Cryptocurrency Tax Guides Help Koinly

14 Best Crypto Tax Software To Ease Your Calculation And Be Compliant Geekflare

Calculate Your Crypto Taxes With Ease Koinly

Calculate Your Net Income Manitoba Give Tax Rates Pensions Contributions And More Net Income Income Tax Income

Capital Gains Tax Calculator Ey Global

11 Best Crypto Tax Calculators To Check Out

14 Best Crypto Tax Software To Ease Your Calculation And Be Compliant Geekflare